Data is becoming the new oil. Companies nowadays collect all data they can, whether they need it or not. This also includes personal information of everyone who uses their services. Businesses generate a lot of revenue by using our data for free. Data is worth a lot of money, so collecting and using it should not be free. Therefore, companies should pay tax over the data they own.

Profit from using data

When we visit businesses online, they store as much information about us as possible. They try to find patterns in our data so they can be a couple steps ahead of our moves. You could say that they know you better than you know yourself. This data is fed to algorithms, which can accurately predict the user’s interests, opinions and internet-behaviours. This information could of course be used to improve the company’s services. Instead of seeing random feeds and ads, these could be personalized according to the user’s interest. This in turn, is lucrative for the company, because their ad revenue increases. To improve these algorithms, a lot of data is needed. The bigger the data-flow of companies, the more these technologies can be improved.

One way that companies are able to acquire so much information is trough cookies. Websites track every virtual move you make, where you click and what you like. These cookies can be very useful, for example, when websites remember your password. But companies also use this to their own advantage. For example, when you search for airline tickets, the price for the ticket increases for every time you look it up. By keeping track of what you search for, companies increase their product price accordingly, because they know what you are interested in. Next time, when you are on a plane, ask your fellow passengers how much they have paid for the same flight. The answers may surprise you.

Our privacy at risk

Where is the harm in this, you may ask? The fact that these businesses gather so much data about us also bears its risks. The data the companies collect also include your private information, like your bank accounts, pictures, texts, et cetera. You would not want this information to get into the wrong hands. Companies storing lots of sensitive information is attracting hackers. Just in 2019 alone there have been 5 major data leaks. In 2011 Sony’s PlayStation Network servers have been hacked and many bank accounts of the users have been breached. This data could be misused, for example, for identity theft, as blackmail or even to steal your hard earned money. At the end of the day, we want to have control over our own privacy and we want to know what is happening to our data.

Another issue, is that some companies also make money from personal data by selling it to third parties, for example, data brokers. This makes it harder for the consumer to keep track of who exactly have access to their data and how it is being used.

Moreover, people are often not aware of the fact that companies gather all this information about them and how they use their data. We are under the assumption that Facebook and similar online services are free, but we do not realize that we pay with our data. Facebook is able to collect our location, our unposted messages and much more, with little control over it. In their privacy statements, companies do mention which data they collect and broadly describe how they will use it, but they could later use this data for different purposes which the person did not know about. They appear to be very transparent in how they handle all our data. Meanwhile, Facebook was fined five billion dollars due to privacy violations, because of their role in the Facebook-Cambridge Analytica data scandal. This shows that companies often do not fully disclose the usage of their data.

In recent years, the societal discussion with regards to the online privacy of people has become more prominent. A company that can show they are regulating the collection of data will have a better image to the outside world. WhatsApp gave us a good example of why this image is so important. At the beginning of 2021, WhatsApp informed their users about their new privacy terms. This new update gave the application more rights to process the users’ data. The new privacy policy tells us that WhatsApp shares information with Facebook, which was not there in the earlier version. These new changes made lots of WhatsApp-users stop using the app. Even Elon Musk, CEO of Tesla, encouraged people to switch to Signal.

Many companies (like Google) respond to the privacy concerns by showing an increased intrinsic motivation to change and by emphasizing that they value the privacy of the customers. These are all nice words because they know that the customers value their privacy. In reality, the privacy policies of companies are there to protect the company, but they do not stop the businesses from collecting or selling our data. Therefore, the intrinsic motivation from companies or the societal pressure alone is not enough. We also need top-down regulation from the government, for example, in the form of a data tax.

Pay for what you own

It is clear that the use of personal data should be regulated. By introducing data tax to companies, they will be forced to stop collecting data recklessly, like they do now. They have to pay for the data they own, just like for the physical things they own. Companies have to start making a choice of what data to collect, because collecting everything will be too expensive. By restricting businesses in this way, the collection and handling of data will be considered with more care. The companies will subsequently be able to tell the user what their thought process is, as far as the user should be concerned. In this thought process, a company’s ideas and plans should be clear and it should be clear what they are going to do with the information. So instead of asking users to accept vague terms and conditions, which most people do not read, they could show a list of what kind of data the company would like from the user. Thus, one hoped-for result of introducing a data tax, is that the transparency and accountability of the company will increase. Consequently, the users of a service will have a clearer picture of why their data is being collected and what it is being used for.

A possible argument against a data tax is that the service of certain websites would decrease, because they have less data to personalize your account with. However, this does not necessarily have to be the case. Companies can find other ways to make their services more appealing. Moreover, this is an opportunity for the user to take back control over which data they give to companies. This way, data can perhaps even become a sort of currency that we can “pay” in exchange for unlocking more services. This makes people more conscious about the fact that these services are not free, but that they are paying for it with their data.

A fair tax system

Another important consequence of the introduction of a data tax, is that it would make the corporate taxation system fairer. The current corporate tax rules were conceived for traditional businesses, where taxes are paid over the profits where the value is created. Where and how much a country should tax a business is largely based on having a physical presence in that country. However, these rules are outdated and with online businesses it is more difficult to decide where to tax. Companies that make use of online data do not make profits from the data itself, but rather by what they do with it. The profits come, for example, from targeted advertisements. The data is therefore a hard-to-value intangible asset. The possession of data is hereby often overlooked in the current tax system. A data tax could help maintain the integrity and long-term sustainability of the corporate tax system. It preserves a social fairness and a level playing field between all businesses. Furthermore, an updated tax system ensures the nationwide tax incomes do not diminish with the digitalisation of businesses. As additional advantage, it would improve the perception of fairness for citizens by ensuring that large companies with significant digital activities do not escape their taxes.

The tax profits could in turn be used to improve the digital economical world. By doing research on the digital economy, the technology could be improved even faster. The salaries of public tech experts could be increased to attract more people doing this kind of work. Moreover, governments could use this tax money to create more robust oversight of digital business. It could be used for the enforcement of the privacy laws that should prevent businesses from exploiting personal data.

Less data, less energy

Besides the advantages a data tax would have for us as humans beings, it could also have an indirect positive effect on the environment. Data has to be stored in a physical place, which is often in data centers. These data centers cost a lot of energy, to run the equipment as well as to cool the equipment. The data that is being stored is growing exponentially, and therefore, we see that the energy use of data center increases rapidly. Despite data centers becoming more energy efficient, their energy use is already 1% of the global electricity demand and is said to increase to 8% by 2030 in the best case scenario. If less data is being saved, it will significantly decrease the energy use.

Rules and regulation

There are already certain privacy laws in place. In 2018, the General Data Protection Requirements (GDPR) law was introduced in Europe, which protects citizens with regards to the processing of personal data and the free movement of these data. It is one of the largest data privacy laws in the world and applies to all businesses that handle data of citizens in the European Union. The California Consumer Privacy Act (CCPA) is a similar data privacy law in the US, which gives consumers more control over the personal information that businesses collect about them. These laws contribute to the highly needed regulation of data collection. However, these laws do not prevent companies from using our personal data for free. A data tax could therefore be a good additional policy to ensure that companies pay for what they own.

One could argue that the governments should not interfere this much when it comes to the amount of data companies have. We live in a capitalist society after all. However, companies already have to pay taxes on the things they own or on their revenue, so why not on the data? As explained earlier, there are several different ways in which these businesses can use our data in order to increase their profits. It is the governments job to impose restraints on the practices of companies and to keep a balance in society between the interests of citizens and the interests of companies.

A fair implementation of data tax

It is obvious that data tax is important and that is is much needed in this new technology era. Now, only the question remains of how this data tax should be implemented. The most obvious way would be to let companies pay a standard price per amount of data storage units they own. However, certain information can be more lucrative than others, and moreover, the profit made from this data can differ from company to company, depending on how big the company is and how they analyze the data. It would be unfair to let a company like Facebook pay the same amount of tax as smaller online companies. A high tax could hold upcoming companies back from growing, because their profit relative to the data tax would be too skewed. On the other hand, if the tax is too low, it would not affect big companies like Facebook. This should be considered when implementing a data tax.

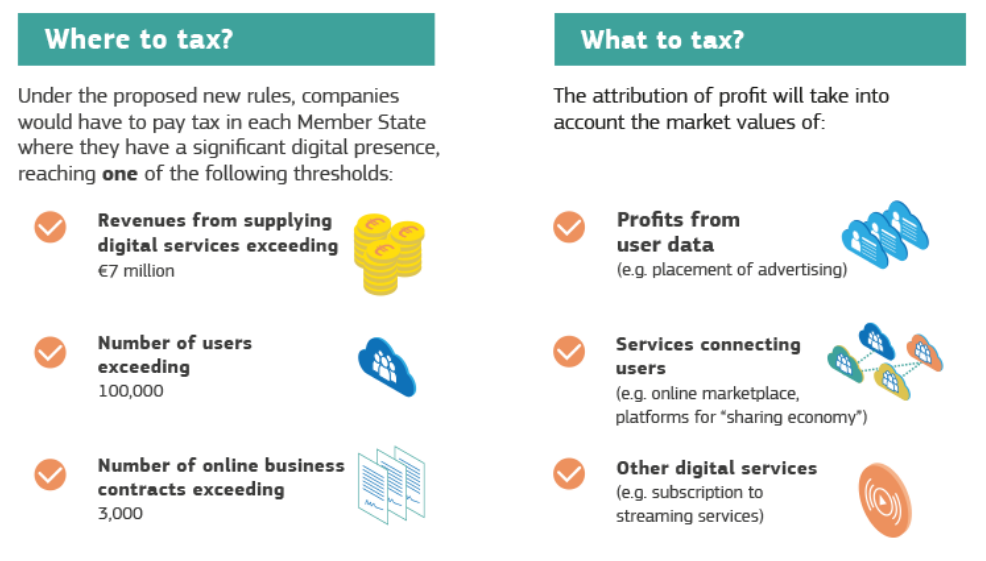

In 2018, the European Commission already proposed a taxation plan of the digital economy. This plan would enable states to tax profits that were generated in their territory, even if the company does not have a physical presence there. The company would have to pay tax to a state in which they have a significant digital presence, measured by: the annual revenues they make in that state, the amount of users they have, and the amount of business contracts for digital service they have. If a business reached the threshold for one of these criteria, they would have to pay taxes to that state. They would have to pay taxes over the profits made from user data, for example, by the means of targeted advertisements. Unfortunately, this plan was not implemented due to the fact that they could not reach consensus. This does show, however, that policymakers are discussing this topic and it gives hope that a data tax will be implemented in the future.

The digital flow of data keeps expanding faster than policymakers can implement laws for this. There are various ways in which the regulation of data use by businesses should be improved, but the implementation of a data tax would be a step in the right direction.